For the many eons since human civilisation invented commerce, business has always operated on a simple formula. You procure or produce something, you add a bit of markup to the value it costed to procure or produce and sell it at this “marked-up price”. This ensured you were provided with a “return” for the time you invested in the activity. It is pretty simple, right? You are in business to earn money. And to earn money, you have to sell at a higher price than you buy, this is only logic and commonsense. The higher a markup you could command on your buying price, the more money you make. And all throughout human history, the struggle was to either sell as much of any stuff as possible, or to push the markup as high as possible to earn the maximum that was worth. This was the fundamental law of commerce, a “natural” law like Gravity.

As long as we do not try to contravene such systems of nature things will run smoothly. We could also try to “engineer” systems to push against these laws. The system will still work, but only as long as the externally engineered force acting against the “natural” law can sustain. For instance, a coconut will always fall downwards from the tree. That is natural. If someone “engineers” a coconut to “fall” upwards instead, it is understood that this is not natural and can only be the result of an external force acting on the coconut. As soon as that force stops acting, coconut falls to the earth obeying the default laws of nature. Such artificial systems are everywhere around us. These systems are forced together by massive, resource-sucking external forces, mostly for the benefit of a few, and the repercussions will be huge when (not if) they fail, the coconut landing on the collective heads of the masses. Such systems can easily be identified as they usually go against logic and commonsense. Have you ever seen something and thought “Hey! How could this be possible? This makes no sense!” There, you’ve identified one.

Unnatural Business

The greatest contemporary examples for such systems are indeed all these new age digital app-based gig economy businesses. Once heralded as the force that would “disrupt” the existing world economic order through a “digital revolution” where a “gig economy” would free every man from the shackles of the Man and feed them with the sweet, sweet nectar of digital decentralisation. The promise has barely made it out of the driveway but all those vaunted businesses, from Uber to the one-person, one-laptop idea that wants to become Uber, are already busy falling apart at their seams. Not really sure if you know, but none of these app-internet-digital businesses are managing to get back the money they are spending, forget making profits. Uber has not just never made a profit it in its entire existence, but is losing money at the rate a billion Dollars every three months! And this is the story for every single such business. The amazing this is that they are still thriving! Why are these entities still in business? In the real world, if a business can survive for maybe a year with losses, two or three if it is big enough (not counting establishments with political patronage). Here they don’t shut down, but operate on an impunity that is almost like they don’t even have to make money out of the business! And funnily enough, all these startups want to become “Uber” as well! Do they aspire to become such money sucking “businesses?” Or do they just want to become “Uberesque” in name and fame? Mostly the latter, one could safely presume. What sense does all this make?

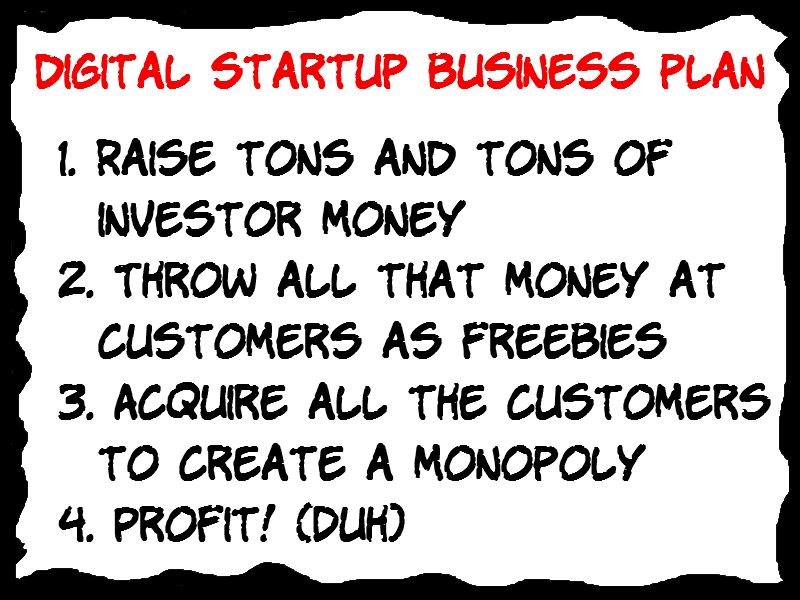

It isn’t that difficult. “Digital businesses” are the coconuts of the business world, spinning in a bubble kept inflated by artificial external forces against the laws of nature. And investor money is the “external force” that props them up. Tech companies are gauged on a benchmark called “valuation”, fancy figures that usually mean to say “how much the company could be worth if sold now“. These valuations are not “real” money, but baloney pulled out of the clouds, imagined numbers based on vague assumptions. Such valuations are not real, because real wealth needs to be backed by physical goods or services, and cannot be conjured out of thin air. With these “valuations” the very concept of money goes out of the window. This is why a tech company that has never made a profit and is losing a billion Dollars every month is “valued” at $7 billion! This is also how founders are valued in the millions. Don’t “investors” have any wish for profits? Or is it that it all is about great, lofty ideals, that money is secondary, to changing the world? Yeah, right. Well, Softbank recently told founders to mark them a clear path for profit, so yeah, it actually looks like profits weren’t really part of the business plan until recently. Oh, and what exactly is that business plan?

Unnatural Business Plans

If you were to go around digging for business plans for digital business, you will find that deep inside, there is only one digital business model, that of discounting. Providers plan offer services at less than established market rates and add further discounts on top of this, all using VC money. The reasoning is that enticed by the discounts, customers would flock to them putting traditional competitors out of business, and once everyone else is priced out, they can raise their prices to whatever levels they please to make enormous profits. It is in this future of magical lights and unicorn farts that investors put their money in. The reality is that this model is simply not workable because of user natures that nobody seems to consider. Customers acquired through discounting tend to be extremely price-conscious, who are in the game exactly only because they are being given discounts. They care two shits about loyalty and either shift to a cheaper alternative or vanish the moment prices increase. You cannot make them form a habit. And this is why they can never be a monopoly. If the Uber surges to more than say Rs.25/km (which it often does), I will just take the bus, or if a taxi ride is imperative I call the good old neighbourhood taxi guy. And this is why even after throwing away all that money for nearly a decade, none of those digital disruptors are even close to achieving their goal. What goal you ask?

Though capitalism talks about competition in the best interests of consumers and other such fairy tales, the end goal is always to eliminate competition to create monopolies. Monopoly is capitalism’s endgame. However, monopolies cannot form naturally because competition is natural, so a “digital Darwinism” sets in where those with the biggest VC clout can out-discount everyone else for survival. However, it looks like that is not working anymore, it would never have. This is now evident by the means of a string of high-profile IPO failures. Uber was banking on its IPO with levels of hype on the level of only second in line to some Malayalam superstar movies. Only, it tanked spectacularly. So, given that the stock market also thrives on “imaginary” valuations and money, why didn’t they offline euphoria reflect there? Simple. Unlike VCs, stock market investors want quick and tangible returns. Why would anyone want to invest in a company that only makes losses? A company that has no cash balance, no assets or no investments, other than an “idea” is good to gloat about but gives no sauce.

Natural Outcomes

The biggest crime of this “gig economy” model thing is that it goes against the laws of nature. When this model is used to sell things at prices below their production costs, every ride, every book, every t-shirt, every ticket, every data packet is sold at a loss. They have to pay the driver/printer/supplier/manufacturer/provider for their supply more than what they earn, using investor money to plug this deficit. So, basically, some idiot VC is giving all us free money to splurge! The problem is that though valuations are imaginary, all this “free” money being thrown around is very real. And all that money is flushed down the drain, wasted with no returns, residue like bathwater. In a real, econonmy functioning according to the rules of nature, that money could’ve been put to use to produce real goods or services, pay real salaries and hence improve living standards of people and stuff. And there is only so much money that can be thrown away, because that also will come to an end. And when that happens, which is now that it has happened, the external forces have given way and the businesses will fall like coconuts as natural laws take over. The result is of course, a global economic glut, suffering, death and despair, yada yada yada. At the ticket prices they were offering, Kingfisher wouldn’t have survived even if they managed to fill every single flight.

If you want a healthy economy and healthy and happy people, sell things making a return on what it costed to produce them. Let those who can afford them, use them, if otherwise under the guise of “enabling consumers” you try to undersell things, you get rampant consumerism, inequality and all the misery that accompanies it. The laws of economics do not support consumerism. Who knew! Also stop handing over business to technologists and unscrupulous showmen instead of business people.

COCCYX: The best example of businesses or even an entire sector being ruined because things are sold at a loss, is the Indian telecom sector, once the poster-boy of a successful unregulated capitalist demand-and-supply free-market wonderland. After being locked in a decade-and-a-half price war race to the bottom, Indian telecom companies are in deep, deep losses from which they might never recover. This is simply because telecom tariffs in India had fallen to levels so ridiculously low that it wouldn’t make a difference if they were offered for free. They couldn’t recuperate the costs incurred in building up infrastructure, paying access and license fees, admin and marketing costs and salaries from customers. The Indian telecom business model was never sustainable, no matter the customers. There is only so much free money, things can sustain ONLY if they are paid what it costs to produce them.