The World is full of overbearing and nosy people who believe they exist for the sole reason of poking into others’ affairs and to enforce the standards of what they believe are the “accepted norms” of “society” on how to lead one’s life. Their primary weapon of choice is irritatingly repeated questions, like “What do you want to do in life?“, “When are you getting married?“, “When are you having your first kid?” and lately in these days of constipated Globalization, “Why aren’t you buying an apartment??” Tired of answering the aforesaid question, I here present my side of the argument why I think dishing out insane amounts on a concrete box in the sky and then toiling away the rest of my life to pay for it is not really all that cool. I attempt to do so by refuting the claims people make in favor of buying a flat in their attempt to try to convince me otherwise. (of course, none of these applies to the people who have extra cash lying around to splurge on flats. My arguments are strictly from a “monthly-salary-EMI-paying point of view)

“You own the Apartment! You OWN it!”

No you don’t. Nobody really “owns” an “apartment”, simply because there is no real thing as an apartment. It is an illusion, only as real as a confirmed Tatkal ticket booked on IRCTC. When you say you own an apartment, just check what you really own. Some walls? A ceiling? The floor? Take away the building around an apartment and what you get is just a concrete box suspended in the air, the real value of which is only as much as that of the materials used to build it. It is not, in many cases, backed by “real” tangible assets like land and if anything is just a bubble. And legally, the real owners of your apartment will be the bank. They also own you, your wife, your children, your life, your soul, your dog, everything. So would you want to pay rent to the bank at inflated rates or would you want to pay a lesser amount your landlord? You will have to keep yourself bound to that shitty job you hate for the rest of your life to make sure your owners do not tighten the leash on you. Profound:

“What you pay as rent you can pay as EMI!”

No you can’t. To think that EMI=Rent or EMI will only be marginally higher than rent is the biggest misconception uninformed people have about purchasing an apartment. Cut and raw, the EMI you pay will be many times of what you pay as rent. For example, if you are paying rent of Rs.15000 per month for a 3 BHK in a reasonably priced area, your monthly expense on EMI+maintenance for a comparable “owned” house will be around Rs.45,000 per month! That is Rs.30,000 more going out of your pocket without giving any comparable (monetary) gains! Proclaiming that it is your “own” (which it is not) will not do any good because you can’t pay the Home Loan by scratching something off your apartment walls no? It is an expense like owning a car. And your apartment value is really just a bubble because it is an intangible asset, completely dependent on market forces and having no real value on its own. (For my non-Indian readers, Home Loan/EMI = Mortgage/Payments)

“You will have much more amenities and live a better life!”

“With all amenities!” is a staple slogan apartment builders use to peddle their wares. “Oh look, a swimming pool, lifts, multi-gym and club house! Awesome! Now let us totally not use them and pay for these.” Not only do you have to shell out per square foot for these goodies but you have to pay maintenance through your nose as well. All for these stuff you mostly will never use! I have always wondered why people buy all this stuff that they never intend to use. Living in an apartment complex also gives you a chance to be part of a community or the “Association”, a group of people whose main objective is to perpetually squabble and shout at each other to satisfy their egos. You will also be burdened with a laundry list of rules which tell you what you should and should not do, which only will lead to more fighting. People might consider all this “modern”, but living in a concrete jungle with a bundle of cosmetic add-ons under the guise of some perceived lifestyle show-off is not really my idea of a “better life”. And of course, you will have to pay EMIs for 20-25 years! TWENTY FIVE YEARS! Boss, that is half of your entire lifetime! Do you intend to waste your entire adult life by pointlessly working to pay off the bank?? I don’t.

“You will have your finances in order!”

In fact it is the other way around. Financially your life will take a turn for the worse when you buy an apartment. Simply put, where will you have money to spend after paying more than two-thirds of your salary as EMI every month? Buying an apartment will in no way increase your standard of life or save you money, it will only make you spend more and hence lower it! In addition to the EMI and maintenance, any work you do on your apartment from fixing a leaking pipe to repainting, has to come out of your pocket. And after booking an apartment until it is finished you will have to pay rent and EMI. And of course, many builders will not stick to the payment plan provided to you in the beginning so you will always end up paying more. After all this spending, where will you have money left to pay for the good stuff?

“You can do whatever you want! No one will question you!”

What are you planning to do? Blow it up? Mostly, you can do anything you would want to do with a rented place as well, save installing fancy modular kitchens and Jacuzzis, and if you could afford those you wouldn’t be reading this blog anyway. And whatever you want to do in a rented place comes for free as the landlord will pay for it! But I guess people say that they will have the “freedom” to use the apartment as they want. Wrong. They are still bound by numerous clauses and rules of the association and so on. Many house owners don’t really care what you do in your apartment as long as you pay your rent and don’t damage the place. And if anyone means “No one can ask me to vacate my house”, try missing a couple of EMI payments. And in most cases, you will have no say in how your building is constructed, what are the materials that are used and what the floor plans are.

“An Apartment is an Investment”

The latest fad among people looking for an “alternative source of income” is to buy apartments for “investment” in dusty suburbs at inflated prices which get inflated thanks to people looking to buy apartments for investment, meaning to sell them off for profit later on. Perfectly good business plan, considering the belief that real estate prices will always keep going up. This is the same what they said about the Japanese real estate market until 1992 and the American real estate market until 2007 which when went bust took down the entire World Economy with it. There can be only so much demand and so much buyers and so much they will be willing to pay as long as they are able to pay. The Indian real estate market has all the trappings of a bubble, propped up by artificially inflated pricing by vested interests and corruption. The entire thing is precariously stacked up to each other like Dominoes, a slight upset in one factor can cause everything to come crashing down. Lives will be ruined. I am in no mood to sacrifice mine. EDIT: The bubble has burst. Apartments are no longer a viable investment today (2019). You cannot sell one without incurring a loss anymore thanks to a radical economic shift and a huge oversupply of flats.

“Show Them that you have arrived in Life!”

“Whom?” Your neighbour? Your boss? Colleagues? Friends? Relatives? The grocery shop owner? That chick who refused to marry you because you weren’t rich enough? And what will you achieve by “showing them”? The people who tell you this show precisely their mindset. They live to “show” others, on pretenses and pomp, Which I don’t. I don’t care a Neutrino’s posterior about what others “think” about me. And more than that, I don’t believe a person’s success in life can be evaluated looking at the quantity of concrete one has acquired in the air. And not to think that any of those whom you want to “show” will actually give a damn. The “Everyone is doing it so I am also doing it” crowd also fall under this category.

The Other Side of My Opinions

“Hey, you self-righteous moron, so you think all those who bought apartments are fools? You are the only wise old man around here, huh?” – You might feel like shouting this at me after reading this. Of course, lakhs of people have bought apartments and are living contented and happily in them. Many must consider this to be the biggest achievement of their life. Then there are many who have made neat piles of money buying and re-selling “investment” apartments. Good for all of them. These points above were just my feelings about why I am not buying an apartment in Bangalore, Kochi or anywhere else.

Of course, the biggest reason why I am not buying a house has to do with the financial part of it, that I don’t have the money nor do I want to fall into the Home Loan trap. More about that in the next part.

Why I Am Not Buying An Apartment Part 2: The Home Loan Trap

My 2 cents on why One should buy a flat –

If you are going to live in the flat and don’t want to change houses every 11 months, and additional expenses including brokerage and commissions and to everyone in the system.

Avoid dealing with nasty landlords who don’t like your beef eating habits or your Music or your Whiskey.

Kid’s school does not move around the rented apartment.

EMI to bank at 10.5% is more or less the same at the annual inflation rate.

Conservative returns on property is around 12-15% annually minus inflation its still profitable .

Tax saving.

One of the safest Investment option available

Your Kid loves drawing on the wall

Buying a flat is not easy, you might find it difficult but you can always sell it off (while on EMI) if it does not work out for you.

p.s Adsense is showing property Ads on your Blog.

Brokerage and commissions are paid on higher levels while buying flats also. It is possible to get houses on rent without intermediaries but agents will not allow you to transact directly with the owners, unless you are an influential localite.

None of my landlords except one had any problem with my beef, whiskey or music :)

What if you would want to shift your kids’ school?

In the end your apartment will be worth the same thanks to the annual inflation rate

Tax saving – Yes.

Real Estate? Safe investment? Maybe in Bombay, but not in Bangalore.

Anyway the landlord will deduct money from your deposit to paint the apartment. Atleast make that worthwhile no? :)

Exactly. So why go for the trouble?

PS: I have no control on what Adsense shows. And I have put Flipkart ads now.

Another funda worth investigating is the returns on buying stocks for property players ( Sobha, prestige, Godrej, Bombay Dyeing, HDIL etc) or companies that hold land bank like Harissons Malayalam, BF Utilities, Amrutanjan etc.

Half the people who own apartment get their projects changed to an office which is across the city and they get to *enjoy* a 3 hour drive and half of them get an offshore project when they rent this apartment out for lesser money than the EMI. Legally, the life of an apartment is 100 years and after that you own a huge 1′ x 1′ piece of land. That’s what you finally own!

Beautiful, emotional and eloquent argument of not owning an apartment …don’t buy a box in the sky …and on the same roll I think they should take our HRA part from your salary ..

By the same argument , don’t send your kid to school . let him/her enjoy life …because he might just end up like you being insane …the condition describer below and the one your are fast reaching :D :D

What if I told you insane was working fifty hours a week in some office for fifty years at the end of which they tell you to piss off; ending up in some retirement village hoping to die before suffering the indignity of trying to make it to the toilet on time? Wouldn’t you consider that to be insane?…Garland Greene( Con Air )

All you flat owners are still claiming HRA and cheating. And thank you for comparing me with Steve Buscemi. He is one of my role models :)

I agree to your arguement. I think buying an appartment is suitable for a person who plan to settle in a city other than his home town.

Thanks! Well, I believe one should always settle in his home town…

Then where the job in ur empty village unemployment rate at peak, population at peak ,so where job , there we have to go.. else do the GOD pays us the income ? “As far as i m reading money related blogs. 50 k per month is required to run a family.Life is hard only accept it.. .

If yu say settle in home town. we have to live in poverty . only 2 person lives in king size bed

1.)politicians 2.) Already became business magnents (like reliance local business )

If not now, later on.

correct

Are you saying buying an apartment is not a good idea, but buying an individual house is good. I have stopped here to post this comment before reading your other parts, so don’t mistake me if you have answered that already.

That is exactly what I meant. I have answered your question in the next parts actually :)

I dont know if you have moved cities or countries and then looked back at this problem. I lived in Virginia for 8 years, rented a place and on an average I paid around $650 rent. (The rent started at around $400 and moved all the way upto $850 for a small apartment). At the time of relocating back to India, I really wondered if I was wise in renting for all those 8 years. I had spent roughly $64000 on rent with nothing to show after 8 years. Property was pretty cheap when I landed there, and even with the bubble burst, the area I lived in retained (prices actually more than doubled looking at the particular 8 year period) prices pretty good. At that time I could have bought a decent condo for around $100000 (even lower), spending roughly $1300 (or below) on mortgage per month for a 8 year loan. (Working out to roughly $131000). Now even if I were able to sell that condo for $130000 after 8 years, I would have lived in that place for free. To be on equal terms with renting, the price of that condo should have more than halved. I picked this example since you mentioned the US bubble.

The first thing I did moving back to India was to start looking at a house to buy. I was single at the time. I pegged housing loan emi to 60% of my salary at that time for a 15 year loan. I save roughly Rs. 70K on rent, another Rs. 20K on taxes (roughly maybe more). I bought a land and house at a walk-able distance from my job (isnt this a problem with people not looking around properly rather than the buying itself?). In 2 years land prices in the area has gone up 50%, I’m not single anymore, also emi now works out to roughly 25% of monthly take home. This was an interesting point you raised, but if you wait for that magical 20%, you might never reach that point. Might as well bite it when you are young and single and get to that 20% in couple of years. I understand there could be a bubble somewhere round the corner, but for now I am happy taking that risk.

But I agree, apartments are not a great idea and I would not buy one. Yes, It is difficult to sell an apartment in a place like Kochi.

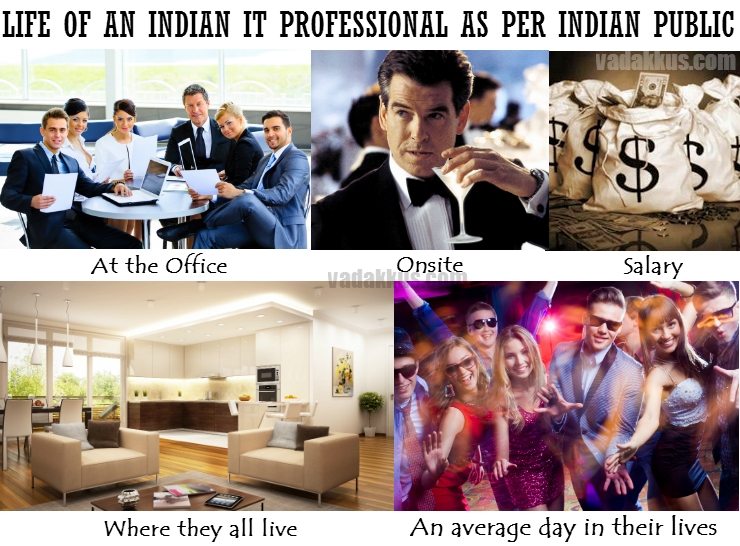

In your case, it worked in your favor that you had the money to pay for it. If I were in your position, I would’ve done the same thing. When I was a bachelor and prices were low, I still used to earn a meager amount (I am not in IT, so no onsites and stuff), only which wouldn’t have made it possible. Not even the 20%. I would’ve had to fall back on my parents, which is not the right thing to do (which most people actually do). And you did buy land and a house, which is a solid investment, not like an apartment. Even if the bubble bursts, you have your land which is something tangible.

I would’nt have bought that house int he US because if I didn’t intend on spending the rest of my life there though. Thanks for reading my blog!

Nice blog, I agree with your post completely. Unfortunately, a lot or transactions in Bangalore happen for the “investment purpose” and not for an individual use, which makes it even more worse.I am happy that you did not follow the herd. I have always advised my friends to either go for ain independant house (for own use) even if it is built on just a 20*30 site, and not to simply assume some unrealistic returns and deploy a life’s fortune in a flat for investment. you blog is a real eye opener.

Thank you so much! :) Yes, this is my aim too, to buy a plot no matter how small it is, and build a small home that I can call my own in its entire sense :)

Today I read this , and decided to saty away of this Bank loan trap… thanks for saving me :)

Today I read this , and decided to stay away of this Bank loan trap… thanks for saving me :)

Today I read this , and decided to stay away of this Bank loan trap… thanks for saving me :)

nice blog..ur right..in Bangalore.. there is mad rush for apartments, they r just blind.. the quality of construction is also poor.. builder sell 10 lakhs worth property for 40-50 lakhs.. there are 500 fools ready to buy it.. even if he increases the price 50-60 lacks 400 fools in Bangalore are ready to buy it.. till fools are there ppl wil go on cheating.. In bangalore the cost of movie ticket in weekday in 100-150 whereas in weekend its 350-400, still our educated fools watch the movies in weekends this makes them increase the prices to whatever they feel. Even private bus operators in Bangalore increase prices on weekend no one to question,, fools are there everywhere in bangalore to pay what ever shit they demand. This city is a hyped city..these real estate shits, increase the price of land & property for their commission . So ppl so just think before you invest ur hard earned money on land or apartment

You are right. One real estate agent once told me that it is clueless IT employees and expats who raise up prices fin Bangalore. I stopped traveling in private Volvos altogether for the past 3 years and take only the train, even a Tatkal AC ticket costs only 1400 while private bus fares will reach 2500! Idiots pay whatever is asked and as a result prices do not come down while salaries haven’t increased in the past 2-3 years. They will only learn once the carpet is pulled away from under them.

yes , same thoughts , worst planning in the city , worst city in the world , people here in the Bangalore suffering from pollution in air and water , unnecessary huge cost of living

Hi,

Wonderfully written blog, a must read for all willing to jump on the home loan band wagon.

FYI: I do have a jacuzzi at home and still care about where and how i invest my money :)

Thank you! You having a Jacuzzi itself shows that you care about where you invest :)

Thanks for writing this up, I only wish there was an option to like something over and over!

exactly my thoughts :)

Your viewpoint does not factor the social and customary fabric of India. Buying a house is a social decision firstly. India is a Country that is plagued by myriad social problems and housing discrimination is one which people rarely acknowledge. A big city like Bangalore has its own share of gut wrenching stories.

If you are a Muslim or a Hindu with a prominent low caste surname, or even a meat consuming Christian- Renting is always a problem. The ease at which a Brahmin can find houses in any or every part of the city is not the same for the other sections of the society. I think everyone should own a house just to avoid the social problems and more importantly every Muslim or low caste Hindu should definitely own one.

That is a fact, but in renting apartments that is not a big problem. That is what my experience tells.

The “Muslim” part that you mentioned, I agree. However low caste surname has nothing to do in Bangalore. People here are given preference if they speak Kannada. If they speak any other language, they are seen with suspicion.

Coming to the “Muslim” part which you mentioned. Muslims come in groups and they take over the area and convert it into a ghetto. Let me give you a few examples – Jayanagar, Bannerghatta road, BTM Layout (have you seen the monster mosque they have built there?!), Shivajinagar, Russell market, Hebbal, Bommasandra etc all taken over by Muslims who usually come to the area first as tenants and now Malleswaram!! And muslims will not take your advice of buying an apartment. They want LAND, they want to own it one house at a time until the whole town is a ghetto. This is a fact.

Please visit buy-house-in-bangalore.blogspot.com for more details and let me know if I can be of further assistance.

Wonderful 3 part article! Buying an apartment is totally a worthless idea. Just imagine the state of the so called well maintained apartment after 20-30 yrs from now. Go to Mumbai n see how 20-30 years old apartments look, ugly n shabby! Also, Bangalore is developing in an unplanned way, soon it will have water crisis if not garbage. I am from Mangalore and have no plans of settling in Bangalore 20 years from now.So it is always better to stay for rent at a convenient location for next 20-25 years until your kids finish college. I am grateful that I have a wonderful independent home in the beautiful city of Mangalore.

I am living in a rented house from child hood but now I am getting paid ..ugg…………ok in a software profession as a tech lead …hope you can guess my salary now… Every night dream of buying a flat (peer/social pressure) but Iam not convenience`d myself since I always chew all the things you mentioned here… so started buying a land.. and investing in PPF and all other trusted things …And feel happy unless i hear any housewarming invite.. .:D

excellent way of saving the money

Awesome buddy…you just nailed it!!!!!! these were my thoughts and i was telling to all of my friends but they were denying now let them f** themselves

super my friend .

I need to buy you a beer for this article! This is pure gold!

I am not sure if you still hold the same line of thought now. But here's my 2 cents:

1. You cannot compare 15k rent with 45k EMI directly. You can only compare the cost. And the cost is the interest component which gets paid out in 10 Years. So after 10 Years you are only returning what you borrowed and not shelling anything from your pocket. So if I take 10 rs from you and you charge me 15% interest, the extra cost which I have to pay from my pocket is only 1.5 rs

2. You cannot again calculate 15k against 45k EMI because EMI is constant there is going to be a marginal variation in the amount. On the other hand, expect you rent to go up by 10% every other year. If you want to keep the rent amount constant, you will probably have to kep shifting away from the City centre which means you need to put more time in travel

3. After 20 Years even if I don’t live there I can rent it out to folks like you. You guys will keep paying me rents for the next 30-40 years of my life :). And mind you, in 20 years the rent would far exceed what I paid as EMI

4. 30% theory doesn’t make sense. Your salary is going to increase but EMI will still be the same. You will take 3-4 yrs to go from 1l to 1.5 l. but the house the that you will buy between 30K and 50K will have a huge difference. But agreed on the point that you need to keep the EMI's in a certain limit to ensure you are covered for contengencies

5. Macro factors – Population. Population is only increasing. Land is becoming scarce and high rises are going to be the way to go. So its not as bad an investment as you have mentioned

6. The real decision is not about getting stuck in home loan, it is not as bad as it sounds. The real decision is understanding if it is best for you or not. If you are planning to start your own venture then ofcourse it’s a bad decision to buy a flat, if not then you should. If you "Plan" to start your venture and you dont, its probably the worst decision you could have taken. So the true question is know your strengths and weekness and then take investment decisions

I am not sure if you still hold the same line of thought now. But here’s my 2 cents:

1. You cannot compare 15k rent with 45k EMI directly. You can only compare the cost. And the cost is the interest component which gets paid out in 10 Years. So after 10 Years you are only returning what you borrowed and not shelling anything from your pocket. So if I take 10 rs from you and you charge me 15% interest, the extra cost which I have to pay from my pocket is only 1.5 rs

2. You cannot again calculate 15k against 45k EMI because EMI is constant there is going to be a marginal variation in the amount. On the other hand, expect you rent to go up by 10% every other year. If you want to keep the rent amount constant, you will probably have to kep shifting away from the City centre which means you need to put more time in travel

3. After 20 Years even if I don’t live there I can rent it out to folks like you. You guys will keep paying me rents for the next 30-40 years of my life :). And mind you, in 20 years the rent would far exceed what I paid as EMI

4. 30% theory doesn’t make sense. Your salary is going to increase but EMI will still be the same. You will take 3-4 yrs to go from 1l to 1.5 l. but the house the that you will buy between 30K and 50K will have a huge difference. But agreed on the point that you need to keep the EMI’s in a certain limit to ensure you are covered for contengencies

5. Macro factors – Population. Population is only increasing. Land is becoming scarce and high rises are going to be the way to go. So its not as bad an investment as you have mentioned

6. The real decision is not about getting stuck in home loan, it is not as bad as it sounds. The real decision is understanding if it is best for you or not. If you are planning to start your own venture then ofcourse it’s a bad decision to buy a flat, if not then you should. If you “Plan” to start your venture and you dont, its probably the worst decision you could have taken. So the true question is know your strengths and weekness and then take investment decisions. Of course am not touching on points on how important it is to chose the right place and project, because I am assuming everybody knows that.

Rubbish! Firstly you are not taking in to account the inflation value. Please note that the rentals will rise and your emi will never rise. 20 years from now, I would love to get off my loan, have a property to live or sell and retire rather than keep paying more rentals than my emi (values now) and ironically continue to pay that for the rest of my life. Even if my flat would only fetch me what I invested (it cannot go less than that factoring in inflation and I’m sure it will be more than that) I would love to retire and keep the money and buy a new one by selling the flat or stay in the same property if I love it. Secondly, tax saving is the biggest take home. Thirdly, have you projected how much your monthly expenses will be when you retire (try retirement planners) and factoring in that you don’t have an own home by then, most of your monthly expenses will be paying rents. Again, you need to understand how the loan repayment works. If you are willing to clear off the loan early, less interest and no prepayment penalty. No one stops you to pay it early and reap the benefits. Again, mentally, the peace in owning is way better than being on rent. You or your family would like to customize it to suit your lifestyle and that’s not going to be possible in rented ones. You cant live in rented ones with suitcases and the same restricted lifestyle. You may want to have kids and they would need their customized space. Imagine the rent in Bangalore 20 years ago and the same now. It has gone up by more than 100%. And it will continue to increase. Even if you consider Bangalore grows only at a very meager pace like any other tier II city and the inflation kicking in, you are looking at monumental rentals 20 to 30 years from now. Imagining you would live for 80 years and one would be in a soup answering his kids “Only if I would have…”. My dad never was interested and had the same argument as that of yours and my mom pushed him in to purchasing one. Now in his retirement days, he says, “How lucky I was then to have done this. I cannot imagine staying in a rented house now with the rents sky high.” He has savings all for himself and need not pay anything except property tax once a year. And forget the pain of changing the house because the owner wants to move in or he will ask you to vacate as you have stayed for long enough (and you should read about this more). The valid question is “Is it worth investing in a 90L apartment whose EMI is way higher?” That depends on your lifestyle and for me it is not worthy financially. You have to understand one thing. Most of the people who purchase 90L apartments should be in their 40s and now have already savings with them for upfront payment (They would have saved by selling their older property…see the advantage ??). They will not be paying emis for the entire 90L. So they chose to upgrade their lifestyle for no cost (the property that they bought back helped them to upgrade). Fixing your emi payment for the next 20 years is not necessarily bad. It can give you rentals and peace of mind and a property you can dispose off later. But the mental satisfaction is immense as I look at my dad now.

Investing in luxury properties in Goa is a solid investment though.

If nothing else, you can retire there?

Better to go for value investing whether house or stocks. You should not pay more than the construction cost, taxes and land value of the undivided share of land. It is hard to identify but not impossible. That means a 2 bhk should priced under 50 lakh including all the charges. Even building a small independent house will cost around 30 lakh excluding the land cost. If you identify such a flat at a good location, you can easily get around 5% rental income and the remaining profit will come from the property appreciation over the years when the construction cost goes up. Even if you sell the property after 20 years nobody will quote less than the construction cost at that time. In 20 years the construction cost would go up by 500% least, considering the current level of inflation. Also calculate the rental income you would have made in the next 20 years with an average increase of 10% rent annually. Intelligent people will not buy overpriced property. Account books of the many of the firms are inflated and stock prices go up exponentially due to insider trading. In that case how can one invest in stocks. At the end of the day stock trading is pure gambling where one makes money only when someone else loses. Vadakkus’s argument can be right for the exorbitantly priced apartments. Independent house does not give security as an apartment. Many people are robbed and killed in independent houses. If nobody buys apartments, how will people without affordability to buy a house rent? Real estate is the only reliable investment available in India which can hedge you against inflation, otherwise, the value of your money will get eroded over the years. Stay away from the big reputed builders if you don’t like to pay ridiculous amount just for the brand name which means nothing as all the builders use the similar raw materials and follow the same construction standards. Finally don’t forget the number of both direct and indirect jobs created by the construction industry which is the largest employment provider in India. Things should be seen from a macro perspective. I rest my argument stating that when one dies whether apartment or independent house cannot take with that person, so take life lightly and live to the full.

There is another big problem with apartments that have come to light right now. See, the life of an apartment is around 40 years, though looking at the building quality of many apartments, it is doubtful if they will survive that long. People say apartments to be a “long-term investment”. How long is long-term? Imagine you want to sell your apartment after 15 years. You will get next to nothing for it. Who will pay the going rate those days, imagining that prices will always only increase (which they won’t), for an apartment 15 years old with old fittings, design, decor and furnishings, instead of a brand new apartment at the same price, in the same area? Would you? I wouldn’t. What my argument, what like you correctly said, was exactly against exorbitantly overpriced apartments.

“Real Estate investment” is buying land, or houses sitting on plots. Not apartments. Unless you are buying it to live in it and make your life out of it for 40 years, buying apartments hoping to resell them for a profit later on is foolishness. Taking a loan to buy apartments to resell them for profit later is utter stupidity.

Since the stock market is a pure gambling and rigged by insider trading, other than real estate is there any other reliable investment option available in India for the retirement saving, as the social security for the retried people from the private sector in our country is zero?

Always go for an inexpensive (economical and affordable) and completed property where Occupancy certificate is obtained and try to pay off the loan within 10 years to make better returns from the real estate investment. A property without occupancy certificate is an illegal property and can be razed by the authorities anytime. The thumb rule should be never to go for a flat costing more than 50 lakh including all the charges such as parking, registration etc.

Top 10 Advantages of Rainwater Harvesting in Apartments – Atz Properties

In the pursuit of sustainability and cost-efficiency, Atz Properties has a remarkable opportunity in embracing Rainwater Harvesting Systems within its buildings. Rainwater harvesting is a practice that involves collecting and storing rainwater for various uses, offering a multitude of benefits to both the environment and the property itself. This comprehensive guide explores the advantages and Benefits Of Rainwater Harvesting, its potential cost-effectiveness, and its role as a water-saving technology for Atz Properties.

https://www.atzproperties.in/blog/advantages-of-rainwater-harvesting-in-apartments